Good morning, Market Forum

For the record---long OJ--bot feb bean call--bot feb ng put

OJ looking nice!

SH looking for bottom--nice call to sell MetMike (low today?)

NG on huge reversal--lots of time left to close.

Looking to sell $ prob tomorrow

Watch KC

OJ's only chance is for the most extreme cold to show up and the push into the southeast be maximized with a storm in the East.

Chances of a MAJOR freeze in FL are probably something like 5% for any one year.

Maybe a 20-30% chance for some kind of a tradeable freeze "scare" in any one year.

I would guess a 50% chance for at least a decent freeze scare with this pattern.

Good afternoon, MetMike and Forum

Since I am long, I would not be upset IF there were a freeze, which accentuated my position.

However, I am long because:

1. Monday completed a daily cycle WITH a %R daily buy signal.

2. Monday completed the weekly cycle WITH a weekly %R buy signal.

3. Monday completed a triple bottom, summer 2016, summer 2017, and now winter 2018.

4. Anticipate no less than a 3 week rally, probably 5-7. Resistance is in the 140-170 range.

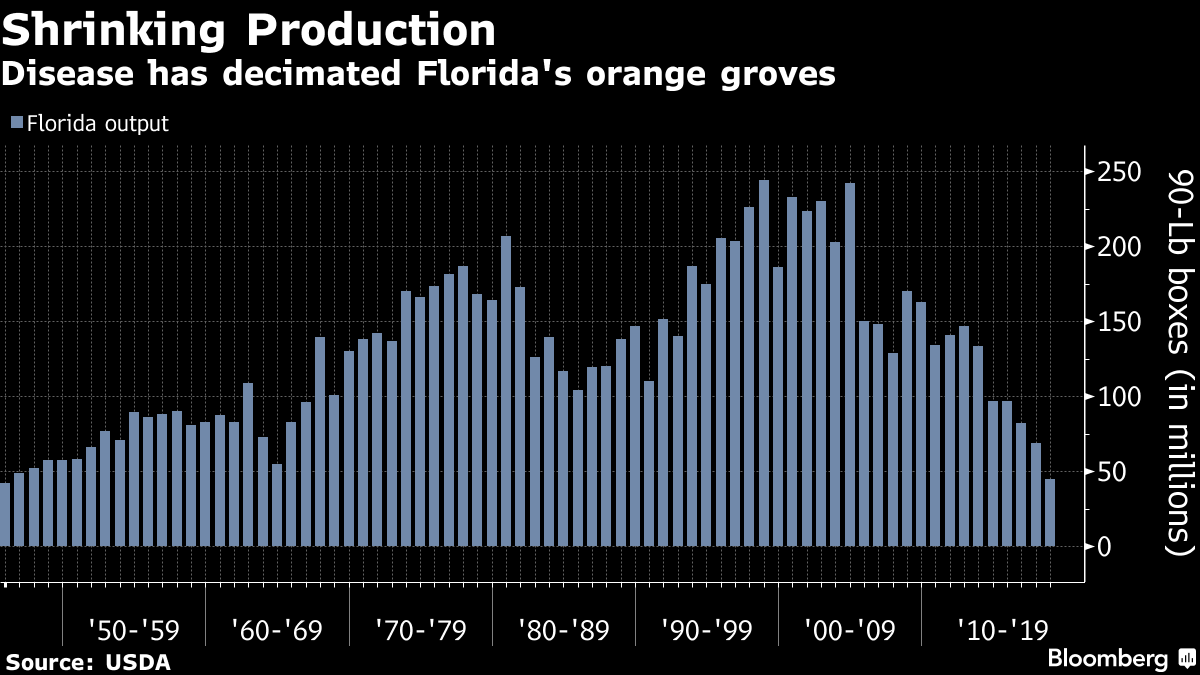

I see that these are the lowest oj prices in several years. Maybe you can be succesful at picking a short term bottom. The current weather pattern, with sub freezing air within striking distance of the Florida orange groves, may be supportive.

Seasonals for oj in non freeze years are strongly negative at this time of year.

Sao Paolo in Brazil is a much bigger producer than Florida.

https://www.fundecitrus.com.br/pdf/pes_relatorios/1218_Orange_Crop_Forecast_Update2018.pdf

Thanks to 'tjc' for doing the background cycle analysis presented earlier. Maybe now the o-juice pops?

Thanks to 'tjc' for doing the background cycle analysis presented earlier. Maybe now the o-juice pops?

O.J. had a mini flash crash volume burp in the final fifteen or so minutes of trading. Past evidence indicative of a bottoming here as price is coiled into a narrowing wedge. Bullish divergence abounds across many time periods and shorts may be crowded as the polar vortex falls south. I imagine Brazil's Real and dryness would be fundamentally supportive. Using the settlement price results in a hammer candle separated from the previous day's settle by a tiny gap. Makings of and island reversal perhaps, abandoned baby style. Worth a look right here.

.png)

Hayman,

This could have represented a short term selling exhaustion, especially by the longs who were desperately hanging on with hopes that the Polar Vortex cold would somehow make it into Florida and a couple of days ago, it finally looked to be an impossible dream........so they covered by selling.

Yup, exactly that Monsieur Met Mike. Bingo. Bang a Gong!

It struck me too that the drought in S.Brazil and Sao Paulo, where they grow more than double the orange crop as Florida could have been a factor in this potential bottom.

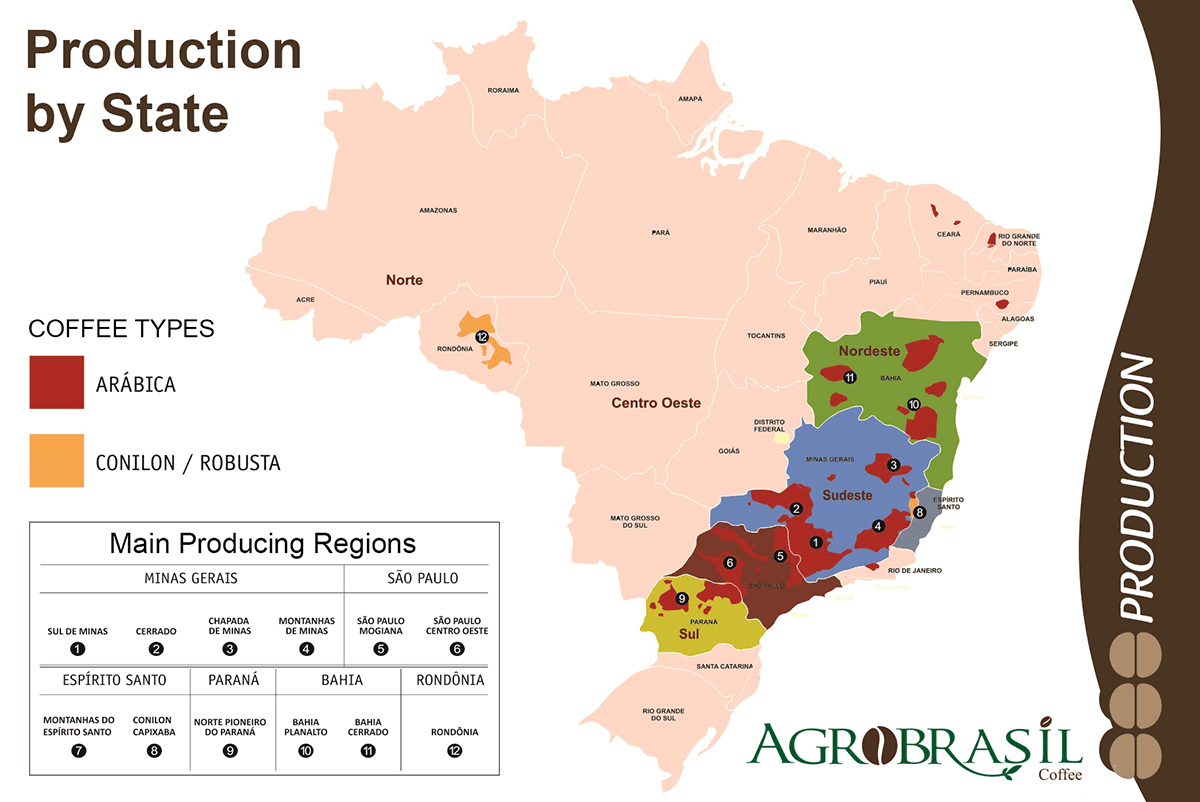

Note that Coffee has also spiked higher today and they are just one state north of where they grow the oranges....Minas Gerais, where its also been very dry.

http://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

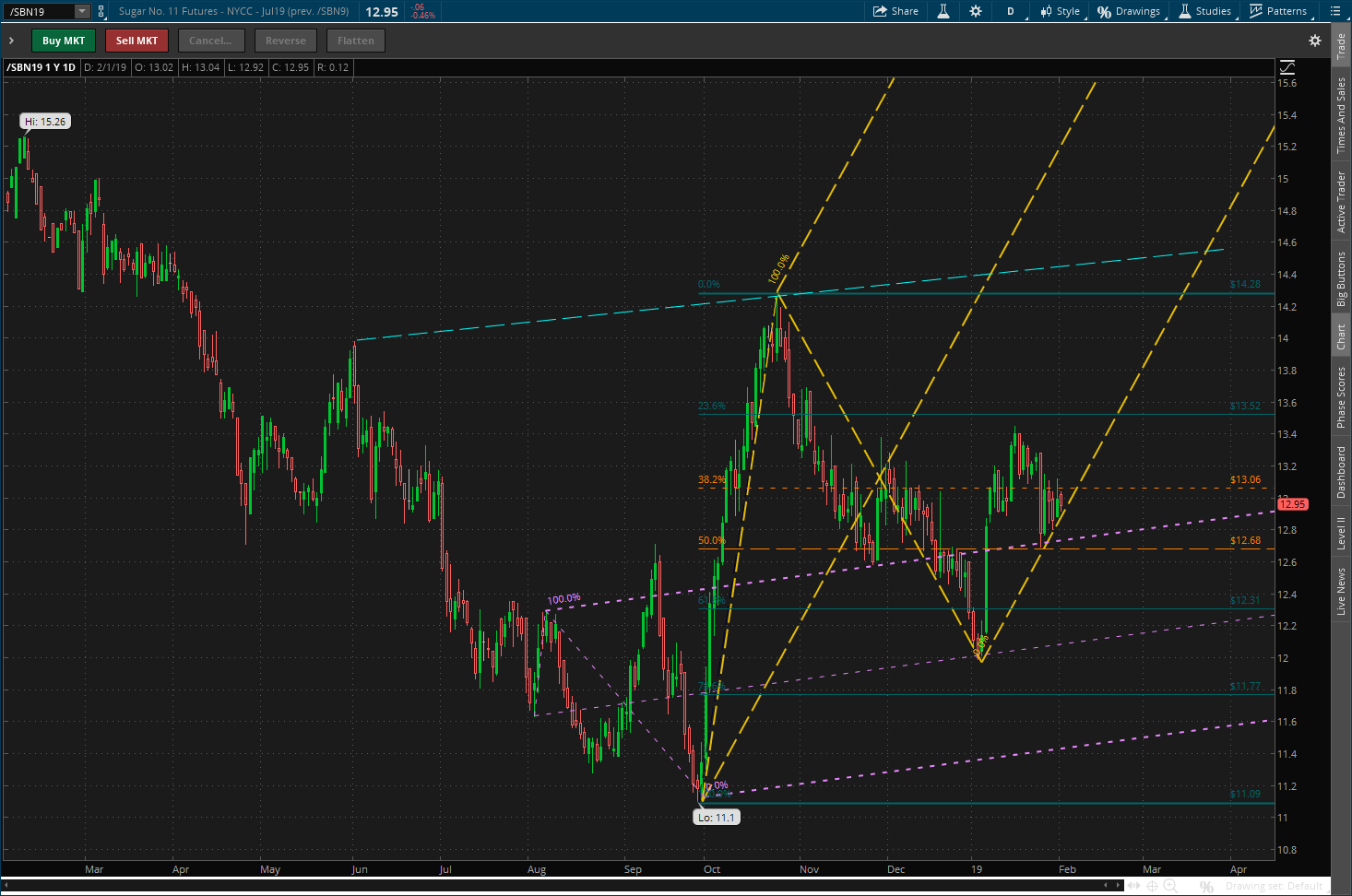

Since you present a meteorological context for this price scenario, the soybean firmness, despite obvious carryout concerns is comparable to sugar's price tightness, regardless of well known supply overhangs. Sugar growing areas in Brazil are shared with coffee, orange juice or soybeans? The sugar is very intriguing chart pattern implying massive support right here. A required building block from which to launch price into the teens and beyond. The concept of a presumed abundance of oversupply that suddenly poof gone is a rude awakening that makes powerful propellant! Thank you for fanning these embers of enlightenment with your winds of wisdom.Here is July sugar.

Hayman

OJ extended from 21+/_ cycle to 28---but it found its bottom.

I agree SB ready to move--thought it might have a 1200ish bottom. Might have to close eyes and buy.

KC looks ready to breakout above 108. 108 a 'good' buy stop.

CT poised to take off--75 good buy stop

Lumber probably a sell.

I wish I had the courage to sell palladium

Thanks TJC,

Coffee needs the dry weather to continue into a drought.........too much rain in the forecast there to be truly bullish.

However, the rains may be north of OJ country and dryness should increase there in Sao Paolo Brazil.

This is where they grow coffee in Brazil.....the worlds biggest producer.

The higher the number below, the greater the production. 1=highest.

map of coffee production in brazil agrob

Coffee charts going back 10 years:

The last 7 days:

| |

| |

| |

Drought in Brazil in 2014 caused a spike

Drought in Brazil and bad weather globally in 2010 caused the 2011 spike

| |