An announcement of the best quarter in the company's history lead to a selloff at the open. As a caveat, they did highlights costs of Tariffs, but they in no way take away from the current and future profitability of this giant. 3m was a little soft. McDonalds was solid and above expectations. And the majority of earnings reports, so far, show the same

When investors start taking an honest look at the over all numbers, this market is in for a big gain.

I continue buying with both hands as people are giving it away.

https://www.caterpillar.com/en/investors/quarterly-results.html

"This was the best third-quarter profit per share in our company’s history,” said Caterpillar CEO Jim Umpleby. “Our global team continues to do excellent work focusing on our customers’ success and executing our strategy for profitable growth.”

The growth rates in the money supply have been below average for this entire year. I am not sure why but following the oil market and watching the money supply it seems to me that the FED is watching oil more then anything else. IMO until the FED is able to complete break the oil market rally, M2 is going nowhere. With M2 going nowhere, stock will have a hard time and the economic numbers will be heading lower. The question is not are we heading for a slow down, but a full recession?

What happened to your worries about the market when the talk of a trade war began?

What happens (maybe it's already happening) when people start looking ahead to earnings comps when the one time gains caused by the tax cuts are in the rear view mirror?

"What happened to your worries about the market when the talk of a trade war began?"

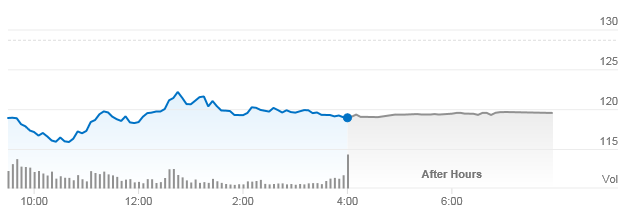

I am still concerned about tariffs. I have yet to see a winner in a trade war. Perhaps this will be a first? But if you can show me any signs, anywhere, of an economic slowdown, or even an impending one, I'll be happy to look at it/them. Add to that the fact that CAT had the best earning quarter in their history and still saw a selloff? Somewhat mitigated by closing BTW. This is not a market driven by rational analysis. But then, day to day, markets seldom are. (CAT YTD Chart below)

CAT Yesterday.(10/23)

"What happens (maybe it's already happening) when people start looking ahead to earnings comps when the one time gains caused by the tax cuts are in the rear view mirror?"

Don't understand this question at all. One time gain? The personal tax cuts are temporary, but have years left. The meat of the cuts, IMO, were the corporate, and they are permanent. That's not just a 16% reduction in federal corporate tax, it's also a cut in all the taxes in the upstream domestic supply chain that are passed on and a reduction in costs associated with tax avoidance and preparation. That's all money that is going to far more productive use and is a big reason for the new levels we're seeing in the GDP.

..... on Friday ....buy copper... best trade of the year under radar

This year comps are benefiting from comparison with pre-tax cut quarters. Unless there are further tax cuts, which I doubt, at some point comps will be vs quarters when the tax cuts were in effect.

What's weak? Housing. https://www.cnbc.com/2018/10/24/new-home-sales-september.html

From MarketWatch:

So, you want to look to the housing market to show an eco-slowdown? A market that has been on a tear for nearly 10 years in the midst of shrinking supply, rising interest rates, a hurricane or 2. OK..

Overall, just about every eco-indicator out there is pegged and decade+ highs.

You are right that a tax cut year could have a bloated effect on profits that may not be present in following years, although there are actually tax hits on assorted depreciation schedules and such in the first year as well that hit finance and energy companies, in particular, pretty hard. (had heavy impact on Q1:18) They still come out ahead, particularly in the long term.

Setting that aside, with increased consumption in a growing economy tends to feed on itself until it doesn't anymore.

Not questioning that most economic indicators are strong. But as you well know the stock market is a leading indicator. It usually peaks when current indicators are rosy. Not saying were're there for sure, but at at these levels with interest rates rising, it may well have discounted a lot of the good numbers.

Cat owes a great deal of their success to badly needed infrastructure repairs and replacements. Construction industry is doing well. For now.

Stock market is a leading indicator? I'll concede that we'll see a stock pullback before a recession actually starts, but if I had a dollar for every equity correction that occurred while the underlying remained strong..... Well, actually I have several.

CAT was not the only company that so far has had a good to great earning report. Many industries are doing quite well right now.

Back to my point, in spite of the best Qtr in history, CAT still experienced a sell off.