If I was trading off the NWS I would feel real good about being long NG tonight.

Thanks Jim,

Average National cooling degree days that are falling and average heating degree days which are increasing, meet each other on around October 4th.

Of course the northern half of the US has already passed the halfway point and the southern parts of of the US will not reach it until late October. So heat in the south and cold in the north is bullish and vice versa but the amount of extreme cold during the next 2 weeks is still effecting an area without much population so overall, heating degree days are below average during the first week and close to average during the 2nd week.

So the bullishness is entirely from the heat in the Southeast half of the US, which lasts thru day 11, then cools off a great deal. After that point, the combination of CDD's and HDD's will move closer to average(by then end of week 2).

The biggest change to me, compared to Friday's forecast is from late week 1 to early week 2 with the heat ridge much stronger over a much larger area for around 5-6 days. However, in the 2nd week of October, temperatures in Chicago to Detroit to New York at 10 degrees above average is actually bearish not bullish because the normal high/low by then is around 65/45........average is 55.

10 degrees warmer than that means no heating or cooling degree days.

Farther south by 300 miles, places that had record heat a couple of weeks ago in the low 90's, will be seeing a similar pattern but only hit mid/upper 80's.

This is warmer than Friday and bullish because storage is very low but its October. In July/August, a forecast like this would be very bullish.

However, adding another 5-6 days with temperatures in the m/u 80's for the southern half of the county vs Friday is having a limited bullish impact so far this evening. It's possible that the funds and others will see it differently early Monday and decide to pile on the long side with aggresive buying as there clearly are more CDD's in the forecast vs Friday.

We are 20% below the 5 year average. 100+ bcf injections are bearish and is what is needed. We aren’t even close and aren’t going to be. It isn’t hard to find projections of prices in the mid teens this winter if it’s a cold winter.

Just wondering about your take on this, mike.

Armstrong posted something on this too:

From comments on the first link - this made me smile:

Damned Global Warming, It’s starting to affect the sun and causing no sunspots…

cfdr...very interesting. Thanks for sharing.

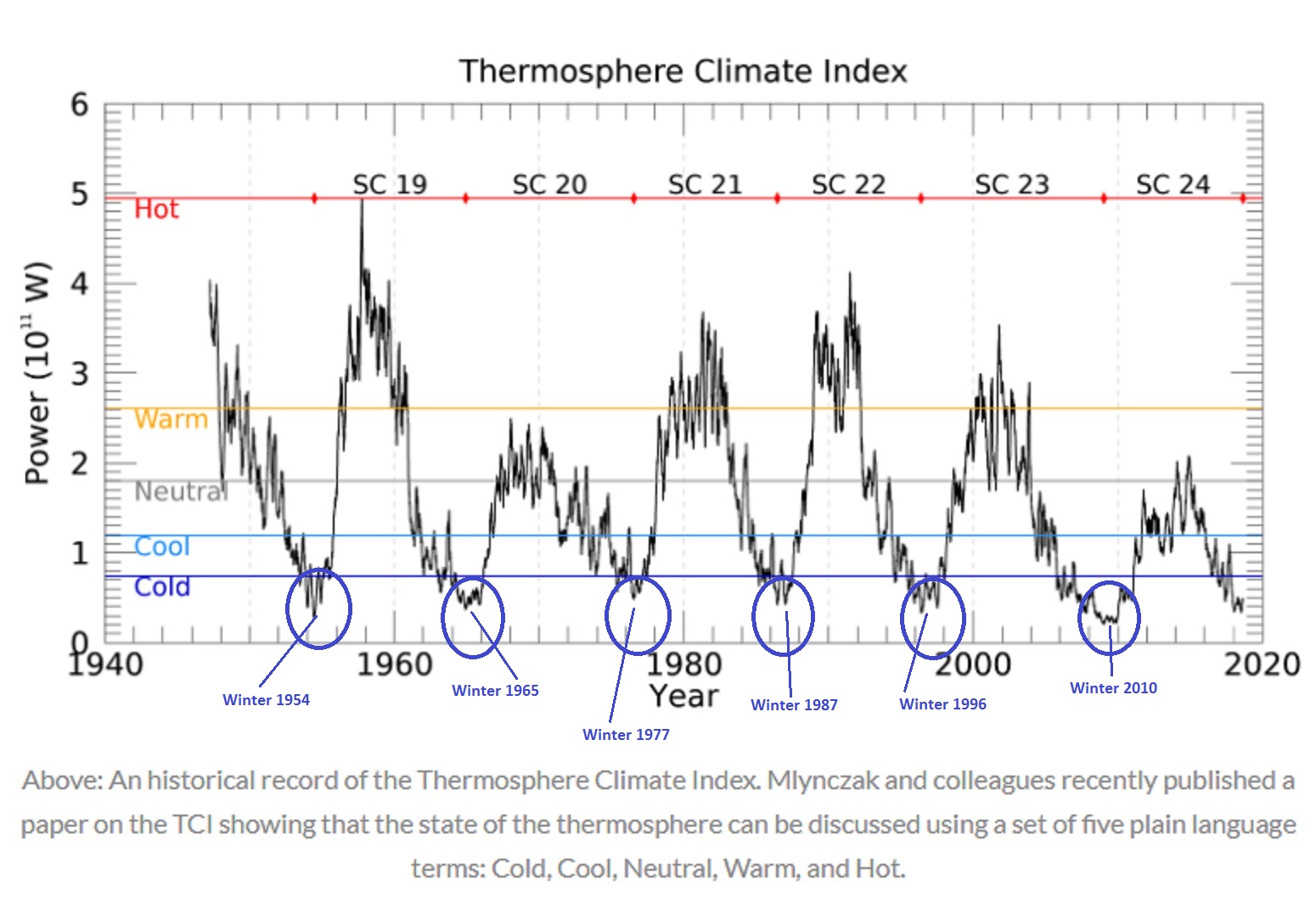

Doing a little more research on this, all of the minimum except 1954 line up with a significant period of negative Arctic Oscillation allowing for the jet stream to dip well south across North America. Not sure the TCI has an influence on AO but it seems to for 5 of the 6 events. 1977, 1996, and 2010 had very cold outbreaks across the Country. 2010 was also an El Nino year so it will be interesting to see what is in store for winter 2019!

Thanks. Looking at the daily and monthly SOI, it sure looks like we might be seeing an El Nino here.

I’m fully expecting we’ll get an official El Niño declared retroactively per ONI definition because they need 5 trimonthlies in a rows of +0.5+ C anomalies in Niño 3.4. Why am I so confident? Not just the SOI but also the subsurface (OHC) is warmer than +1.0 C anomalywise. Looking at OHC history back to 1979, that kind of warmth in September has always been associated with either established El Niño or an oncoming one. I don’t see this being a strong one but rather a weak to lower end moderate one as per ONI.