The sheer volume of the $38.5 trillion debt is only half of the story; the real pressure comes from the cost of carrying it. Throughout 2025 and into early 2026, the "higher for longer" interest rate environment has fundamentally shifted the math of the American economy.

Economists warn that these rising interest costs act as a massive "tax" on future growth. When the government spends nearly $300 billion in a single quarter just to pay interest, that capital is effectively removed from the productive economy. It cannot be used for infrastructure, scientific research, or education. This phenomenon is known as "crowding out," where government borrowing needs suck the oxygen out of the private investment market

https://www.nytimes.com/2025/12/23/us/politics/doge-musk-trump-analysis.html

https://fortune.com/2026/01/26/trump-big-beautiful-bill-national-debt-crisis/

$73,649.33 per second for the past year.

https://www.pgpf.org/programs-and-projects/fiscal-policy/monthly-interest-tracker-national-debt/

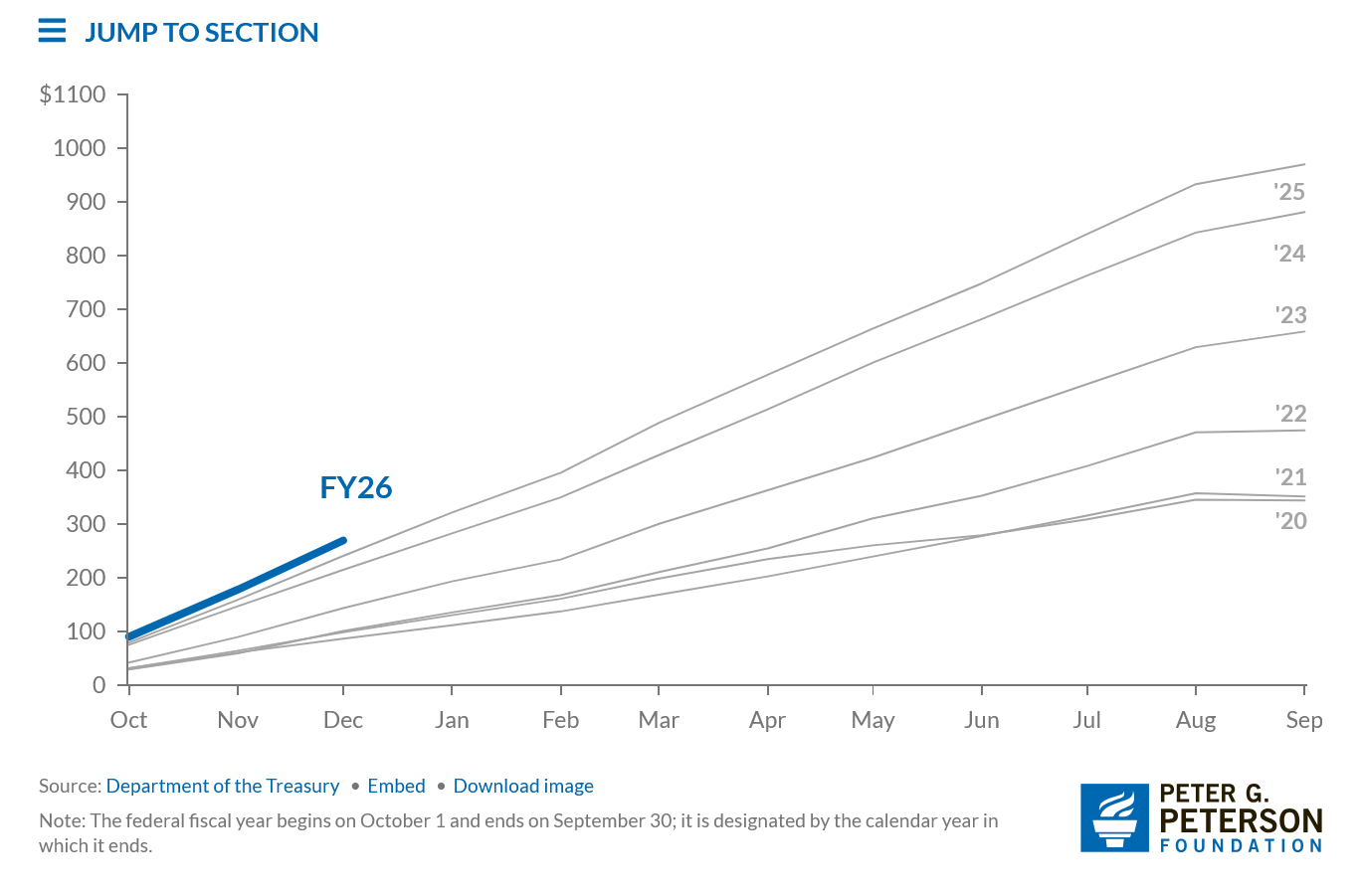

The rapid accumulation of federal debt, in addition to higher interest rates on that debt (relative to longer-term rates that existed just a few years ago), has pushed up the federal government’s cost of borrowing. Through the third month of FY26, interest payments on the national debt have been 11.9 percent higher compared to previous years.

Cumulative Federal Interest Costs (Billions of $)