I was bummed out that I didnt get to short this from the opening till lunch

Thanks much. Nice chart, Mike!

The graph and arrows are showing us your set up for going long and how it was triggered but your words are saying that you were bummed for not shorting earlier when your system did not indicate a shorting set up or signal.

Maybe I'm missing something, please elaborate.

Your system uses an RSI crossover of 50. If it was already extremely low on the morning open, why would you even think about shorting?

Since the RSI was already well below 50 in the morning/near the bottom in fact, there was NO CHANCE for it to come close to providing you with a sell signal.

Anybody using this system would have only been looking to get long from the get go. You can't crossover from 50+ to lower than 50 when the RSI is already way below 50. And your moving average and MACD were in the wrong place for a shorting set up too early in the day.

On the other hand, if the RSI were above 50 very early and then crossed below 50, your system could have triggered a sell signal with other indicators favorable but it wasn't.

Please lift the curtain on my confusion,

Thanks.

I was out all morning working,got home at lunch time and checked the charts. The market opened down,trended down all morning then made a reversal,thats when I bought some call options,zero day expirations.

What I was implying,there was a great short set up all morning that I missed to working in the field,not looking at charts til lunch

Thanks, Mike!

Actually, it was NOT a selling set up using your system as you defined and demonstrated it as I explained earlier.

It might have been a great short using somebody else’s system but the 1 that you demonstrated with the buying set up and long entry points as A DAY TRADER would never have had you selling in the morning.

What different system and criteria would have justified that short, please?

Hull moving average moving down,price bars below moving average,RSI below 50

"Hull moving average moving down,price bars below moving average,RSI below 50"

Thanks very much, Mike!

However, immediately after the day session open the 10 minute price bar closed ABOVE the moving average 2 times and would have taken you out of a short then, correct?

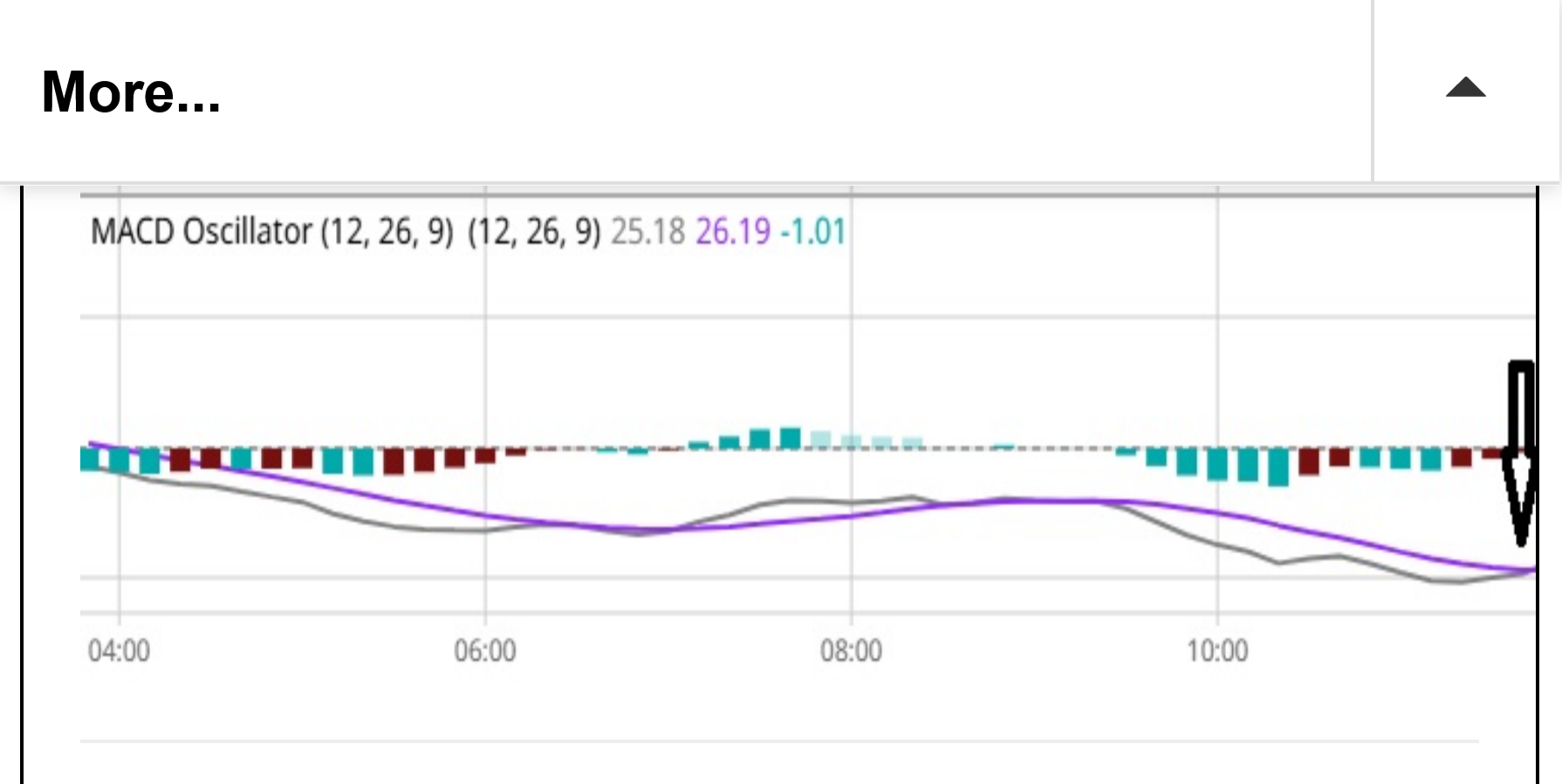

And the MACD crossover was on the WRONG side at the open as well as both the lines still RISING then(bullish) as well as putting off a slight POSITIVE bar after the 8:30 am open.

Close up of the MACD Oscillator below: NOT a short ON the open!

You can make a case for shorting some time AFTER the open based on hind sight, which is always 20-20 but NOT the open for a position which would have been immediately invalidated by 2 closes above the 10 minute bars of the 50 RSI moving average.

What say you Mike?

In the 1990's, before we had this wonderful internet that does everything for us, I had a weekly charting service mailed to me via high priority mail and spent 1-2 hours every day, updating and hand plotting 25 different markets that were added on each week, starting after the Monday close to the Friday close.

Then discard those and start over with the new UPDATED charts, often because the old ones had all sorts of different lines(support/resistance and trendlines) that made them messy. Those new charts came in the mail from the charting service the next Monday.

I did my own moving averages and RSI computations but that became too tedious for that many markets. There is nothing better for learning than by doing hand plotting your own charts of numerous markets daily .

https://www.smbtraining.com/blog/going-old-school-the-value-of-keeping-charts-by-hand

++++++++++++++

Doing this today really would be insane because we have something 1 million times better as Mike demonstrates here with live charts that can be set to update on any short term time frame with whatever indicator a person prefers.

There is great value in Mike's thread and posts in showing it here, even though I disagree with his interpretation of shorting the open on Friday morning using his system and indicators.

His buying signal just after noon which he highlighted makes solid sense. We should keep in mind that hind sight like this is always 20-20 AFTER the markets close.

Identifying those set ups BEFORE they happen and taking the trade, sometimes losing, sometime winning is what happens in the real world, not just displays of all the wins with no losses.