U.S. hiring remained sturdy in April as the economy added 177,000 jobs despite jitters over President Donald Trump’s massive import tariffs and widening federal government layoffs.

But payroll gains for February and March were revised down sharply, largely offsetting the big jump last month.

The unemployment rate held steady at 4.2%, the Labor Department said Friday.

Ahead of the report, economists forecast 135,000 job gains, according to a Bloomberg survey.

Thanks, cutworm. That was a very good report with new jobs exceeding expectations by 42K.

The stock market futures rose pretty sharply on this with the Dow up 400+.

The Dow is now up 445.

After digging into the report and thinking about it more as well as reading others’ analyses, I feel a reality check is needed:

-The Feb change in employment was revised down by 15K (from +117K to +102K).

-The March change was revised down by 43K (from +228K to 185K).

-So, not only do these revisions significantly negate the good news about April, they also may mean a good chance April will be revised downward later.

-The federal govt layoffs included multiple months of severance pay in many cases meaning those job losses won’t show up until severance pay ends.

https://www.bls.gov/news.release/pdf/empsit.pdf

Nevertheless, the Dow is now up over 600!

I've seen that before where the revisions seem to be overlooked by the market.

Could be that a lot of traders were thinking that it would be a lot worse?

cutworm said,

“I've seen that before where the revisions seem to be overlooked by the market.

Could be that a lot of traders were thinking that it would be a lot worse?”

——————

Hey cutworm,

Good question. It could be that traders are thinking that revisions are for periods too far back to matter/old news of sorts and thus they care only about the latest. I’d like to know how stock markets reacted in the past to good news for the most recent month and bad news for further back. Of course, no two reports are going to be exactly the same situations.

Yeah, maybe the whisper number for April was actually much worse. And perhaps the Feb/Mar revisions were somehow already anticipated?

Previous thread:

S & P 500 futures.

36 responses |

Started by mikempt - March 31, 2025, 10:17 a.m.

https://www.marketforum.com/forum/topic/110810/

https://tradingeconomics.com/united-states/stock-market

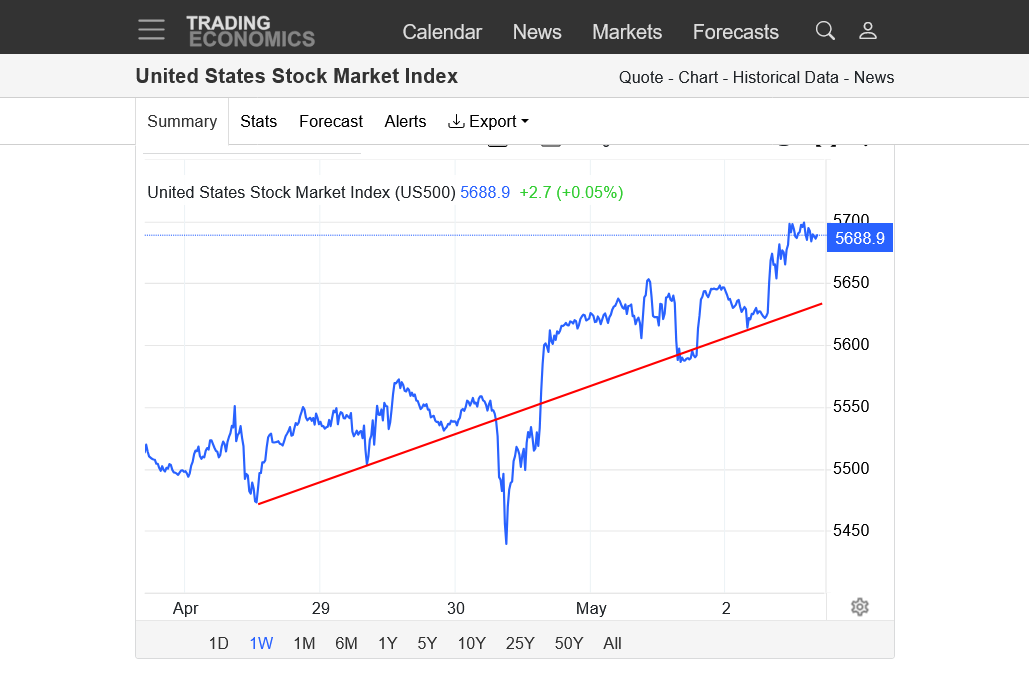

1. 1 week-spike down early Wednesday-otherwise, huge week up

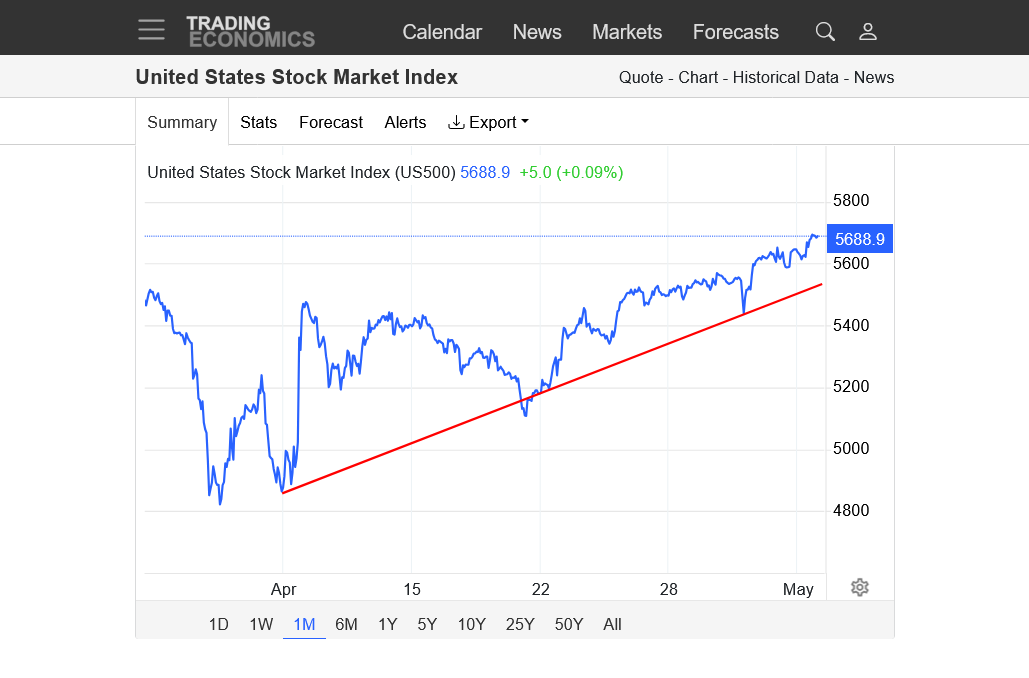

2. 1 month- new short term uptrend with huge gains after the Trump tariff spike low

3. 1 year-Steep, bearish downtrend broken. Horizontal line is the April 2nd high just before the Trump tariff schemes crashed the markets. joj's critical resistance.

4. 10 years-long term uptrend not violated